updated readme with the eda images (#3)

Browse files- updated readme with the eda images (a534d17cb2795cbd274d0d265908ed6d670c9c6a)

README.md

CHANGED

|

@@ -69,26 +69,33 @@ Key features include:

|

|

| 69 |

## Exploratory Data Analysis

|

| 70 |

|

| 71 |

### Brand Distribution

|

|

|

|

|

|

|

|

|

|

| 72 |

The treemap visualization provides a hierarchical view of market presence:

|

| 73 |

- Rolex dominates with the highest representation, reflecting its market leadership

|

| 74 |

-

- Omega and Seiko follow as major players, indicating strong market presence

|

| 75 |

- Distribution reveals clear tiers in the luxury watch market

|

| 76 |

- Brand representation correlates with market positioning and availability

|

| 77 |

|

| 78 |

-

[Treemap Image]

|

| 79 |

|

| 80 |

### Feature Correlations

|

|

|

|

|

|

|

|

|

|

| 81 |

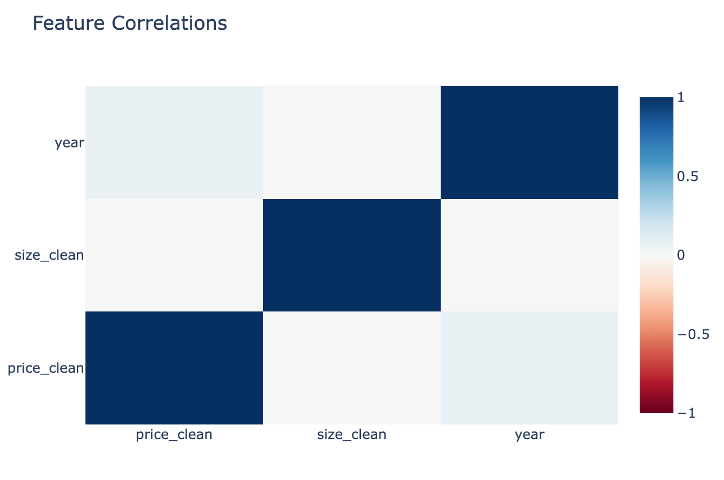

The correlation matrix reveals important market dynamics:

|

| 82 |

- **Size vs. Year**: Positive correlation indicating a trend toward larger case sizes in modern watches

|

| 83 |

- **Price vs. Size**: Moderate correlation showing larger watches generally command higher prices

|

| 84 |

- **Price vs. Year**: Notably low correlation, demonstrating that vintage watches maintain value

|

| 85 |

- Each feature contributes unique information, validated by the lack of strong correlations across all variables

|

| 86 |

|

| 87 |

-

[Correlation Matrix Image]

|

| 88 |

|

| 89 |

### Market Structure Visualizations

|

| 90 |

|

| 91 |

#### UMAP Analysis

|

|

|

|

|

|

|

|

|

|

| 92 |

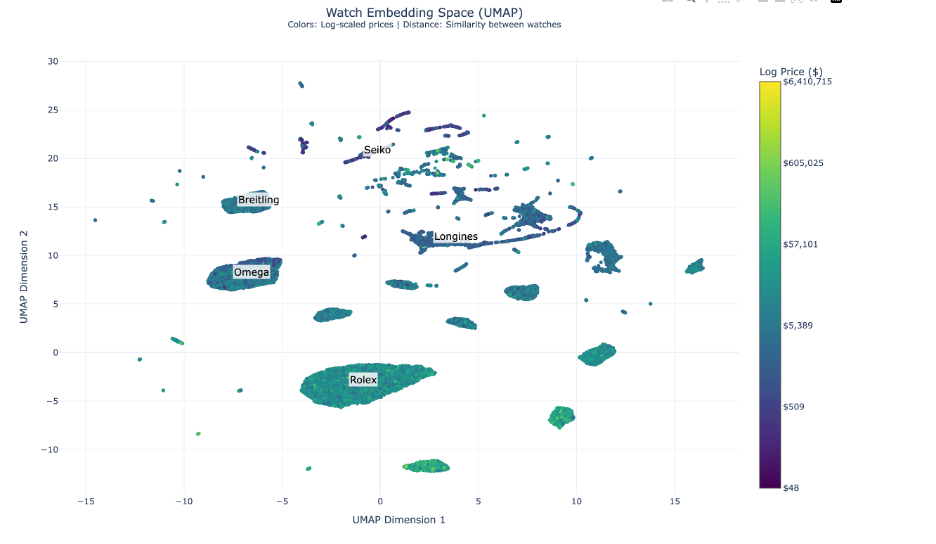

The UMAP visualization unveils complex market positioning dynamics:

|

| 93 |

- Rolex maintains a dominant central position around coordinates (0, -5), showing unparalleled brand cohesion

|

| 94 |

- Omega and Breitling cluster in the left segment, indicating strategic market alignment

|

|

@@ -96,9 +103,11 @@ The UMAP visualization unveils complex market positioning dynamics:

|

|

| 96 |

- Premium timepieces (yellower/greener hues) show tighter clustering, suggesting standardized luxury attributes

|

| 97 |

- Smaller, specialized clusters indicate distinct horological collections and style categories

|

| 98 |

|

| 99 |

-

[UMAP Image]

|

| 100 |

|

| 101 |

#### t-SNE Visualization

|

|

|

|

|

|

|

|

|

|

| 102 |

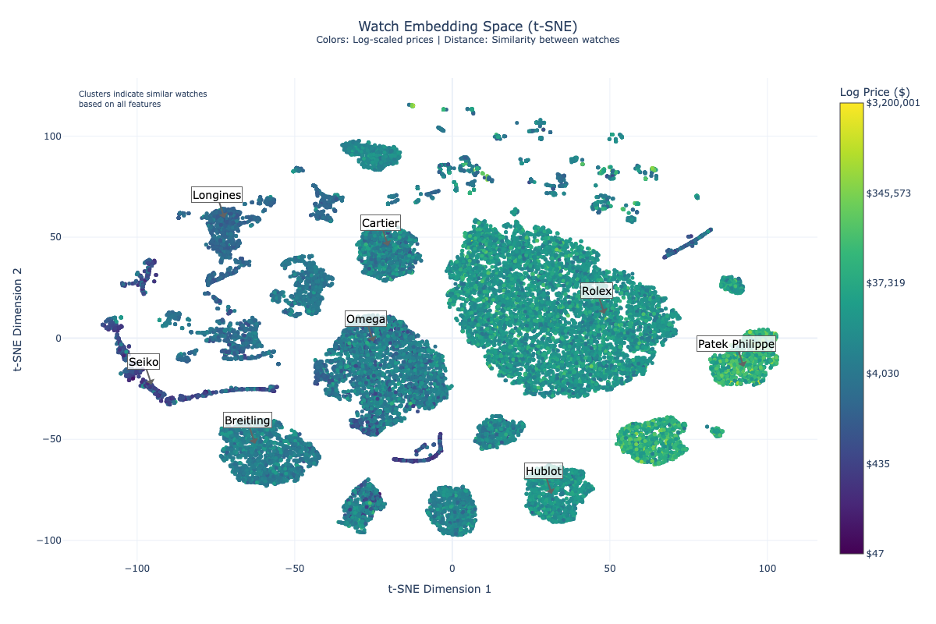

T-SNE analysis reveals clear market stratification with logarithmic pricing from $50 to $3.2M:

|

| 103 |

- **Entry-Level Segment ($50-$4,000)**

|

| 104 |

- Anchored by Seiko in the left segment

|

|

@@ -109,12 +118,13 @@ T-SNE analysis reveals clear market stratification with logarithmic pricing from

|

|

| 109 |

- Cartier demonstrates strategic positioning between luxury and mid-range

|

| 110 |

- **Ultra-Luxury Segment ($35,000-$3.2M)**

|

| 111 |

- Dominated by Patek Philippe and Audemars Piguet

|

| 112 |

-

- Clear separation in right segment

|

| 113 |

- Strong brand clustering indicating market alignment

|

| 114 |

|

| 115 |

-

[t-SNE Image]

|

| 116 |

-

|

| 117 |

#### PCA Analysis

|

|

|

|

|

|

|

|

|

|

| 118 |

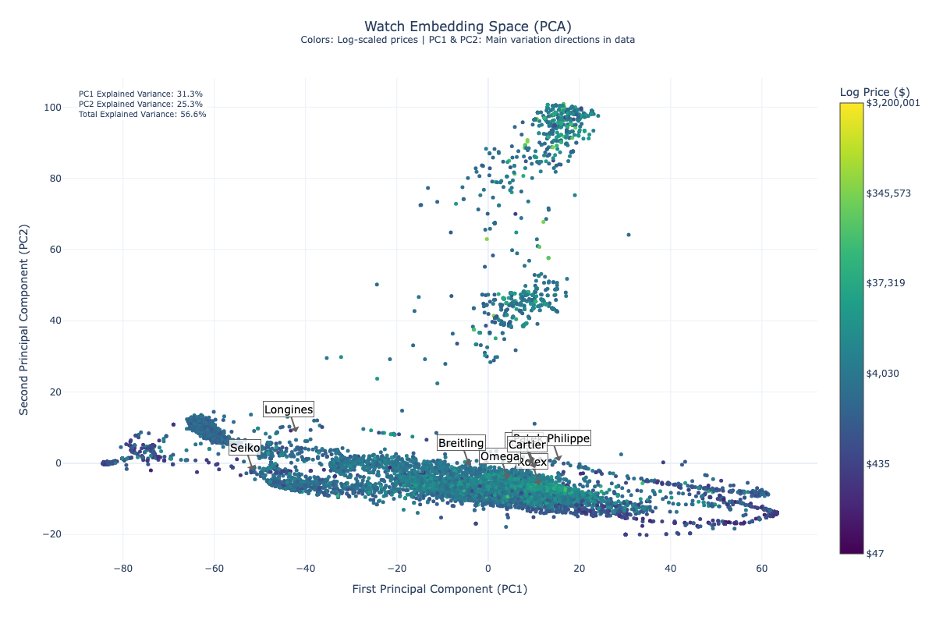

Principal Component Analysis provides robust market insights with 56.6% total explained variance:

|

| 119 |

- **First Principal Component (31.3%)**

|

| 120 |

- Predominantly captures price dynamics

|

|

@@ -125,28 +135,33 @@ Principal Component Analysis provides robust market insights with 56.6% total ex

|

|

| 125 |

- **Brand Trajectory**

|

| 126 |

- Natural progression from Seiko through Longines, Breitling, and Omega

|

| 127 |

- Culminates in Rolex and Patek Philippe

|

| 128 |

-

- Diagonal trend line serves as market positioning indicator

|

| 129 |

- **Market Implications**

|

| 130 |

- Successful brands occupy optimal positions along both dimensions

|

| 131 |

- Clear differentiation between adjacent competitors

|

| 132 |

- Evidence of strategic market positioning

|

| 133 |

|

| 134 |

-

[PCA Image]

|

| 135 |

|

| 136 |

#### Network Visualizations

|

| 137 |

|

|

|

|

| 138 |

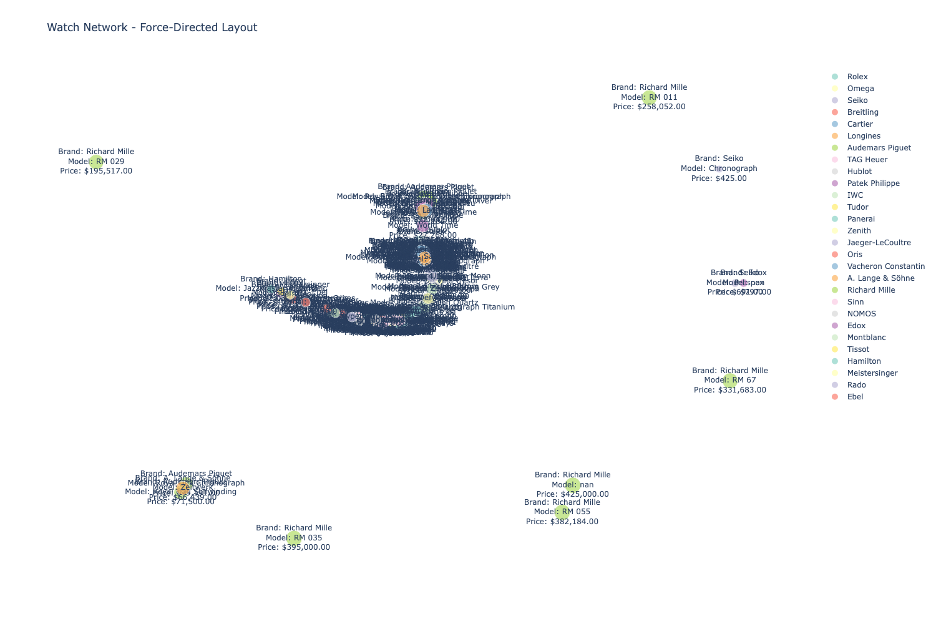

**Force-Directed Graph**

|

|

|

|

|

|

|

|

|

|

| 139 |

The force-directed layout reveals natural market clustering:

|

| 140 |

- Richard Mille's peripheral positioning highlights ultra-luxury strategy

|

| 141 |

- Dense central clustering shows mainstream luxury brand interconnectivity

|

| 142 |

- Edge patterns reveal shared market characteristics

|

| 143 |

- Node proximity indicates competitive positioning

|

| 144 |

|

| 145 |

-

[Force-Directed Graph Image]

|

| 146 |

|

| 147 |

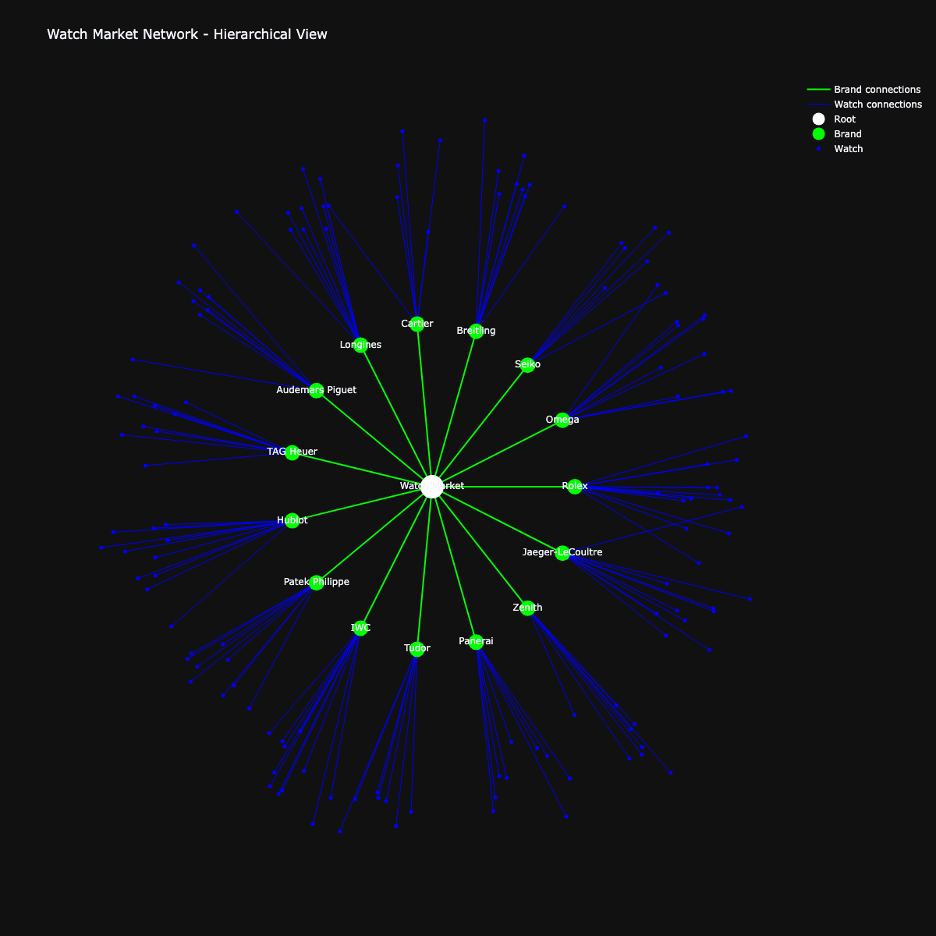

**Starburst Visualization**

|

|

|

|

|

|

|

|

|

|

| 148 |

Radial architecture provides a hierarchical market perspective:

|

| 149 |

-

- Central node represents overall market

|

| 150 |

- Green nodes show brand territories with strategic spacing

|

| 151 |

- Blue peripheral nodes indicate individual timepieces

|

| 152 |

- Node density reveals:

|

|

@@ -155,8 +170,6 @@ Radial architecture provides a hierarchical market perspective:

|

|

| 155 |

- Segment diversification

|

| 156 |

- Balanced spacing between brand nodes indicates market segmentation

|

| 157 |

|

| 158 |

-

[Starburst Graph Image]

|

| 159 |

-

|

| 160 |

|

| 161 |

## Ethics and Limitations

|

| 162 |

|

|

@@ -334,4 +347,4 @@ def get_watch_features(watch_id):

|

|

| 334 |

## Note

|

| 335 |

- The dataset is optimized for PyTorch Geometric operations

|

| 336 |

- Recommended to use GPU for large-scale operations

|

| 337 |

-

- Consider batch processing for memory efficiency

|

|

|

|

| 69 |

## Exploratory Data Analysis

|

| 70 |

|

| 71 |

### Brand Distribution

|

| 72 |

+

|

| 73 |

+

|

| 74 |

+

|

| 75 |

The treemap visualization provides a hierarchical view of market presence:

|

| 76 |

- Rolex dominates with the highest representation, reflecting its market leadership

|

| 77 |

+

- Omega and Seiko follow as major players, indicating a strong market presence

|

| 78 |

- Distribution reveals clear tiers in the luxury watch market

|

| 79 |

- Brand representation correlates with market positioning and availability

|

| 80 |

|

|

|

|

| 81 |

|

| 82 |

### Feature Correlations

|

| 83 |

+

|

| 84 |

+

|

| 85 |

+

|

| 86 |

The correlation matrix reveals important market dynamics:

|

| 87 |

- **Size vs. Year**: Positive correlation indicating a trend toward larger case sizes in modern watches

|

| 88 |

- **Price vs. Size**: Moderate correlation showing larger watches generally command higher prices

|

| 89 |

- **Price vs. Year**: Notably low correlation, demonstrating that vintage watches maintain value

|

| 90 |

- Each feature contributes unique information, validated by the lack of strong correlations across all variables

|

| 91 |

|

|

|

|

| 92 |

|

| 93 |

### Market Structure Visualizations

|

| 94 |

|

| 95 |

#### UMAP Analysis

|

| 96 |

+

|

| 97 |

+

|

| 98 |

+

|

| 99 |

The UMAP visualization unveils complex market positioning dynamics:

|

| 100 |

- Rolex maintains a dominant central position around coordinates (0, -5), showing unparalleled brand cohesion

|

| 101 |

- Omega and Breitling cluster in the left segment, indicating strategic market alignment

|

|

|

|

| 103 |

- Premium timepieces (yellower/greener hues) show tighter clustering, suggesting standardized luxury attributes

|

| 104 |

- Smaller, specialized clusters indicate distinct horological collections and style categories

|

| 105 |

|

|

|

|

| 106 |

|

| 107 |

#### t-SNE Visualization

|

| 108 |

+

|

| 109 |

+

|

| 110 |

+

|

| 111 |

T-SNE analysis reveals clear market stratification with logarithmic pricing from $50 to $3.2M:

|

| 112 |

- **Entry-Level Segment ($50-$4,000)**

|

| 113 |

- Anchored by Seiko in the left segment

|

|

|

|

| 118 |

- Cartier demonstrates strategic positioning between luxury and mid-range

|

| 119 |

- **Ultra-Luxury Segment ($35,000-$3.2M)**

|

| 120 |

- Dominated by Patek Philippe and Audemars Piguet

|

| 121 |

+

- Clear separation in the right segment

|

| 122 |

- Strong brand clustering indicating market alignment

|

| 123 |

|

|

|

|

|

|

|

| 124 |

#### PCA Analysis

|

| 125 |

+

|

| 126 |

+

|

| 127 |

+

|

| 128 |

Principal Component Analysis provides robust market insights with 56.6% total explained variance:

|

| 129 |

- **First Principal Component (31.3%)**

|

| 130 |

- Predominantly captures price dynamics

|

|

|

|

| 135 |

- **Brand Trajectory**

|

| 136 |

- Natural progression from Seiko through Longines, Breitling, and Omega

|

| 137 |

- Culminates in Rolex and Patek Philippe

|

| 138 |

+

- Diagonal trend line serves as a market positioning indicator

|

| 139 |

- **Market Implications**

|

| 140 |

- Successful brands occupy optimal positions along both dimensions

|

| 141 |

- Clear differentiation between adjacent competitors

|

| 142 |

- Evidence of strategic market positioning

|

| 143 |

|

|

|

|

| 144 |

|

| 145 |

#### Network Visualizations

|

| 146 |

|

| 147 |

+

|

| 148 |

**Force-Directed Graph**

|

| 149 |

+

|

| 150 |

+

|

| 151 |

+

|

| 152 |

The force-directed layout reveals natural market clustering:

|

| 153 |

- Richard Mille's peripheral positioning highlights ultra-luxury strategy

|

| 154 |

- Dense central clustering shows mainstream luxury brand interconnectivity

|

| 155 |

- Edge patterns reveal shared market characteristics

|

| 156 |

- Node proximity indicates competitive positioning

|

| 157 |

|

|

|

|

| 158 |

|

| 159 |

**Starburst Visualization**

|

| 160 |

+

|

| 161 |

+

|

| 162 |

+

|

| 163 |

Radial architecture provides a hierarchical market perspective:

|

| 164 |

+

- Central node represents the overall market

|

| 165 |

- Green nodes show brand territories with strategic spacing

|

| 166 |

- Blue peripheral nodes indicate individual timepieces

|

| 167 |

- Node density reveals:

|

|

|

|

| 170 |

- Segment diversification

|

| 171 |

- Balanced spacing between brand nodes indicates market segmentation

|

| 172 |

|

|

|

|

|

|

|

| 173 |

|

| 174 |

## Ethics and Limitations

|

| 175 |

|

|

|

|

| 347 |

## Note

|

| 348 |

- The dataset is optimized for PyTorch Geometric operations

|

| 349 |

- Recommended to use GPU for large-scale operations

|

| 350 |

+

- Consider batch processing for memory efficiency

|